2022 may have rushed past, but it isn’t quite over yet. With the holiday season fast approaching, retailers are steeling themselves for the craziest months of the year. Knowing what retail trends to expect from the 2022 holiday season can help brands and retailers to prepare and carve a strong position in the market in what’s undoubtedly been a volatile economic year.

Overview of 2021 Holiday & 2022 Cyber Weekend

First, let’s take a look at how 2021’s cyber holiday compared to 2022.

Before examining major 2022 holiday consumer trends, let’s briefly take a look at 2021’s holiday and this year’s cyber weekend to see how those events influence this season’s trends.

Given that many consumers were gradually coming out of a ‘strict’ lockdown in the latter half of 2021 as a result of 2020’s COVID-19 pandemic, it’s no surprise that offline retail growth surpassed eCommerce last year, particularly in the U.S. In fact, this was the first time on record that consumers shopped more at brick-and-mortar stores than online. Of the many reasons, some of them were due to the regrowth of the labor market, increasing wages, and federal stimulus aids given to citizens who most likely spent part of it on 2021 holiday gifts.

Regarding the 2022 cyber weekend, there was a highly positive year-over-year growth in overall traffic (global +5.4%, NA +12.5%), sales (global +8.9%, NA +14.7%), and average order value (global +6.2%, NA +10.6%). Black Friday (32.8%) topped the following Saturday (22.8%) and Sunday (20.2%), and Cyber Monday (24.3%) in terms of total weekend sales. Yet, despite all this, the growing pressures of inflation increased the average selling price (NA +8.5%) and decreased unit sales year-on-year (global -4.8%, NA -9.3%).

As a result of high inflation, this holiday season, we’re looking at many retailers mainly challenged with increasing operation costs while many consumers are doing what it takes to get the biggest bang for their buck. For instance, nearly two-thirds of shoppers are planning to cut back on everyday essentials and groceries as prices jump, particularly in December 2022. This means possibly going out to dine less and finding cheaper alternatives, thus switching brands and postponing big purchases.

7 Top Retail Trends Predicted for the 2022 Holiday Season

As retailers prepare for the busiest time of the year amid rising inflation and as consumers begin to bargain-hunt earlier than usual for the holidays, we share with you seven major 2022 holiday retail trends. Having at least an awareness of these predictions can help you create effective discounts and strategies to get the most out of your store or eCommerce sales.

1. Extended holiday season

The retail holiday season is expected to start even earlier this year, driven by shoppers’ desire to get back to ‘normal’ following COVID-19 and rising concerns over costs. Snagging gifts early to avoid inflation pushing prices even higher is a key factor driving pre-season shopping, with 37% of U.S. shoppers stating they plan to start buying gifts earlier this year to enjoy the best prices and discounts and avoid delivery and fulfillment issues.

Brands and retailers should try and use early promotions and wish list-building prompts to pull holiday sales forward to the autumn to capture this share of the market and avoid a swollen late-season inventory.

2. Re-embracing the in-store shopping experience

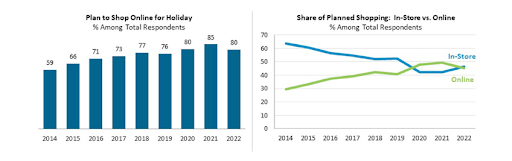

This year we can expect further growth in physical retail in the holiday season as shoppers plan to make more purchases in person than online. It’s estimated that less than 75% of buyers expect to shop online only, down from 79% in 2021.

Great in-store offers, click and collect and excellent customer service can ensure retailers create a more personalized customer experience that builds loyalty and maximizes sales. This graph illustrates how online shopping exceeded in-store spending during the pandemic but is predicted to dip now that restrictions have been lifted.

Source: The NPD Group/ Annual Holiday Survey

3. Price Sensitivity

Product pricing is set to be a big factor affecting both what shoppers buy and when they make their purchases.

Soaring inflation and prices are pushing consumers to spread the cost of their Christmas purchases across multiple paydays or consider BNPL deals. 77% of U.S. adults state that inflation has affected their personal spending, making it unsurprising that 70% of shoppers are waiting for sales/deals before they start shopping.

Retailers can prepare for price sensitivity by setting up early deals and considering expanding product ranges at the lower end of the market – something being embraced by UK retail giant M&S, for example, where 70% of clothing and home gifts can now be bought for under £20 (approx $22.87).

4. Higher demand for sustainable or eco-friendly products

Despite the cost of living crisis, we can expect to see the demand for sustainable products remain strong– a result of our increased awareness of climate change and desire to help the environment.

Not only is there greater demand for sustainable products, but there’s also the opportunity for retailers to ramp up their profit margins since consumers across all generations are willing to spend more on them. Nearly 90% of Gen X consumers say they’d be willing to spend an extra 10% or more – up from 34% just over two years ago.

Brands and retailers can cash in by expanding their sustainable product ranges and making them easy to identify. Amazon shoppers can filter search results to find products that are Climate Pledge Friendly certified. There’s also a Climate Pledge Friendly badge visible on applicable items.

Source: Amazon

5. Fashion/apparel and consumer electronics in retail to take a hit

Fashion/apparel is the most popular eCommerce sector, expected to reach a total market size of $1.164.7 billion by the end of 2025. Nevertheless, 26% of UK consumers have said they will be cutting back on fashion retail shopping this holiday season.

Another favorite is also predicted to lose favor during Q4. The electronics market may be growing, but consumers plan to spend as much as 22.3% less this season – a result of inflation-driven price hikes and the boom in electronic sales during the Covid-19 pandemic.

Adjusting inventory, creating more affordable options, and using omnichannel retail technologies to ensure a seamless customer experience could ensure retailers suffer minimal impact from any reduction in sales.

6. Product returns

Product returns happen every holiday season. This is especially true for products ordered online, which have an average return rate of 30%, compared to just 8.89% for items purchased in-store.

However, returns don’t have to end a relationship with the customer. 92% of consumers would be happy to buy again if the returns process is easy. With returns inevitable, retailers can retain customer loyalty by ensuring their returns process is as convenient and efficient as possible. Consider things like free return shipping (even just for the holiday season), included or easy-to-print return labels, and local drop-off.

7. Trends by consumer group

So, what can we expect from each consumer group?

Gen Z predominantly discovers products via social media, with 41% preferring short-form video marketing – a great holiday season sales strategy to capture this consumer demographic. An omnichannel experience is crucial for this generation, who are also shopping earlier and seeking more meaningful gifts.

Millennials also use social media for product discovery, in addition to Google searches and in-person shopping. 63% of millennials will spend about the same as last year, despite the cost of living crisis, but 45% plan to start holiday shopping before November.

Gen X likes to discover new products through a broad range of channels. Almost half are predicted to start shopping before November, meaning it’s essential for retailers to get their holiday promotions running early. They are open-minded, too, with 43% prepared to explore new brands when holiday shopping.

For Boomers, product discovery takes place on television ads, the internet, and in physical stores. One of the demographics most likely to gift vouchers/gift cards, it’s a great idea to make this option clearly visible both in-store and on eCommerce platforms.