As part of our original series of market research, or what we like to call Voice of the Customer (VoC) analysis, it contains monthly articles written exclusively by our Business Intelligence team who leveraged the Wonderboard analytics to support the research. This article is written by our Market Analyst, Liang Liu, to help more beauty/personal care brands better understand emerging industry trends and new consumer behaviors — all based on ratings and reviews.

Although some parts of the world are still reeling from the recent global pandemic and not everything is fully back to normal, most economies are at least gradually moving towards recovery. As another result of the pandemic, new consumer behaviorisms have emerged across major industries, such as beauty or personal care.

For instance, traditional in-store shopping experiences have been supplemented by a paradigm shift toward online shopping, which provides customers with greater choices and the convenience of basing their purchase decisions on ratings and reviews. In turn, the increasing importance of online product reviews tugs at the attention of personal care brands to better listen to the voice of the customer.

This research article delves into a popular sub-category of personal care – hair care – by analyzing relevant customer feedback to see what customers today are saying about the category. Although often categorized as “personal care,” hair care products have always been more generally considered a “basic need” or an “essential” product for many customers. Most would place them in their grocery carts during regular errands.

However, during the COVID-19 pandemic, many people were spending more time at home, thus becoming more aware of their own mental health. This further led many shoppers to appreciate the experience of using things more. In our case, hair care products, such as investing in facial and hair treatments and general mental wellness services.

Therefore, there’s a higher demand for personal care brands to focus on marketing product experiences to improve customer satisfaction. Read on further to discover three critical trends that Wonderflow’s analysts discovered after analyzing dozens of hair care-related ratings and reviews with a powerful artificially intelligence platform.

Trend #1 – The Popularity of the Fragrance Topic in Personal Care Customer Reviews

When it comes to fragrances, this specific beauty category alone has garnered a 45% increase in sales in 2021, compared to 2020, according to the 2022 State of Beauty Industry. The increasing popularity of fragrance-related purchases shows there’s a trending discussion around the scent or smell of (beauty-related) products, particularly concerning hair care.

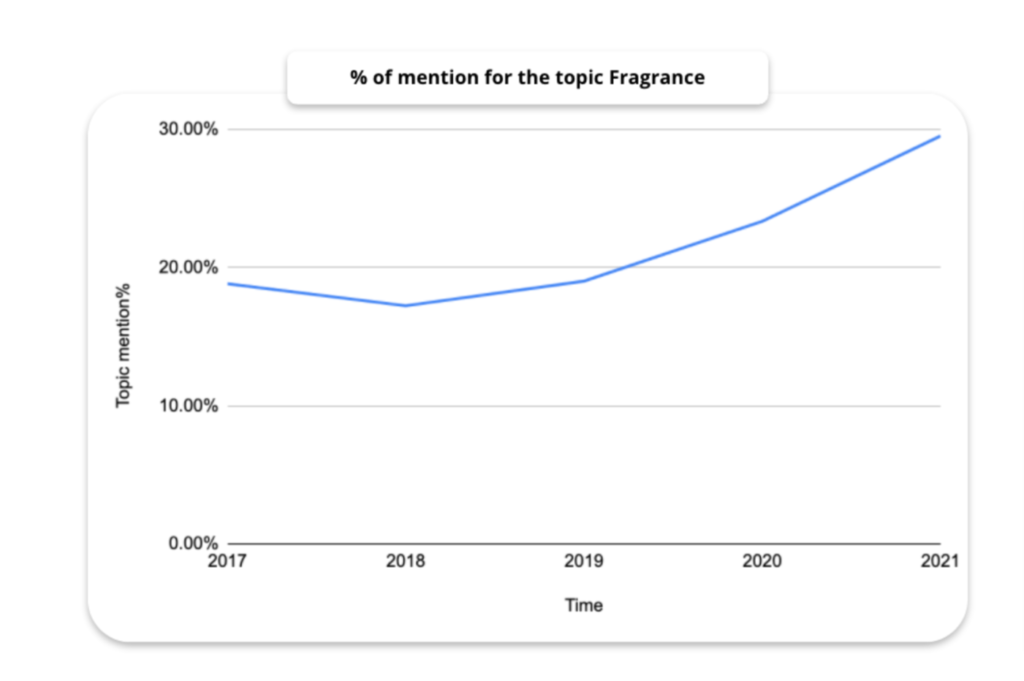

Based on our analysis of dozens of hair care-related reviews, we saw an upward trend in the topic of Fragrance among related products (figure 1). Fragrance is the most popular topic among customers (figure 2) and it has a strong impact on the customer’s decision to leave either a high (positive) or low (negative) product rating.

Figure 1

Figure 2

Figure 3

The increasing focus on a product’s fragrance can further explain why, since 2018, a growing percentage of customer feedback has mentioned “scent” when it comes to reviewing hair care products. The topic discussion has accelerated significantly since 2019. We believe that, mainly due to the “Corona” pandemic, many customers struggle with work-life balance so much that they become more conscious about self-care. In other words, striving to always feel good about oneself and be more relaxed.

In turn, many consumers nowadays prefer finding more products with pleasant odors or scents that help them feel “calm” or “at ease” or “at home” and the like. They focus also on the smell of hair care products than only the basic features they traditionally offer (e.g., cleanliness).

Trend #2 – The Increasingly Price-Conscious Beauty Shoppers

Apart from the increasing consumer talks around cosmetic fragrances, price positioning is another critical component of hair care products. Recent trends in the beauty industry show that price, rather than just brand name, is becoming more and more of a big concern for customers when buying things related to hair care.

Today shoppers are more sensitive and critical about the costs of what they buy overall. One of the biggest reasons for this is the fact that people are purchasing more online, where there are more choices and product comparison information. Not to mention, Gen Z is one of the most self-aware consumer groups in terms of financial wellness. They’re more cautious than baby boomers, for instance, on how they spend their money. Thus, brands must be “financially inclusive.”

To show that there is a rise in consumer price sensitivity, you can look at the decreasing sentiment index trend (figure 4). Although the index score price started to drop in 2016, it fell significantly hard from 2020.

Figure 4

This goes hand in hand with the fact that beauty shoppers have altered their purchase behaviors since the pandemic. More have switched from offline to online shopping, and it is this encounter with more choices online that leads to buyers’ increased criticism of pricing.

Additionally, as inflation rises, the emerging group of constrained consumers becomes more price-conscious. It is no longer enough for customers to rely on brand name recognition alone. Beauty companies should deeply understand the customers’ needs, more than ever before, to achieve a better competitive advantage.

Trend #3 – The ‘Clean Beauty’ Trend

Consumers are increasingly willing to take a risk on unbranded searches for lower-cost beauty products — if and when those products emphasize features related to cleanliness and effectiveness. Also, mentions related to sustainability, including plastic-free, is another beauty trend. Often dubbed “clean beauty,” the focus is more on the ingredients themselves. Shoppers interested in clean beauty brands are more likely to research 5-10 different ingredients before making a related purchase. In other words, naturality or non-toxic ingredients are key to attracting and satisfying today’s growing number of eco-friendly shoppers.

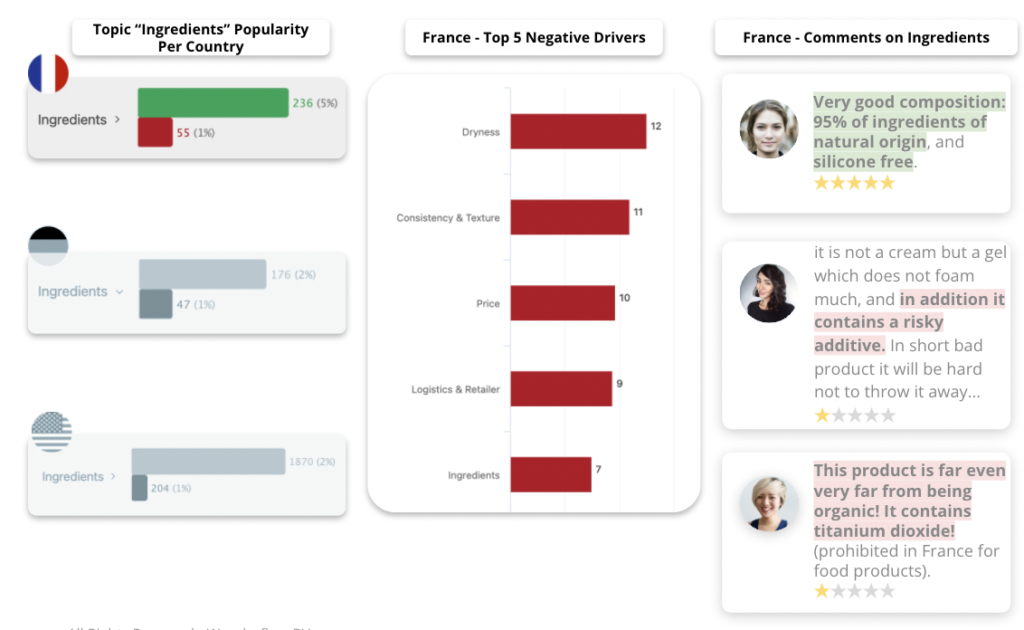

For example, below, we analyzed dozens of customer reviews about shampoos in France, Germany, and the U.S. We found that in France, customers generally care more about cosmetic ingredients than in the other two countries (figure 5).

Figure 5

The percentage of shampoo-related reviews mentioning Ingredients as a topic in France is twice more than US and German reviews. Ingredients, we also found, are among France’s top five negative drivers, while the topic is less relevant in the US and Germany. French shoppers often refer to the clean beauty trend when talking about Ingredients. They expect more or less the shampoo to be organic and natural. Thereby, brands operating in France can emphasize natural ingredients in their beauty or hair care products to avoid the risks of low customer satisfaction and negative ratings and reviews.

Conclusion

Unlike a decade ago, hair care products are no longer an essential commodity to many consumers. Nowadays, shoppers expect such personal care products to do more than effectively clean their hair. There is a demand for more hair care products to offer a sense of relaxation, combined with a pleasant fragrance, sustainable packaging (natural ingredients), and customized pricing. These new beauty trends were mainly the result of the COVID-19 pandemic, when many consumers increased their knowledge of self-care and the value of wellbeing.

Have questions about your own line of cosmetic or personal care products? Talk with our VoC experts and try out our tool!